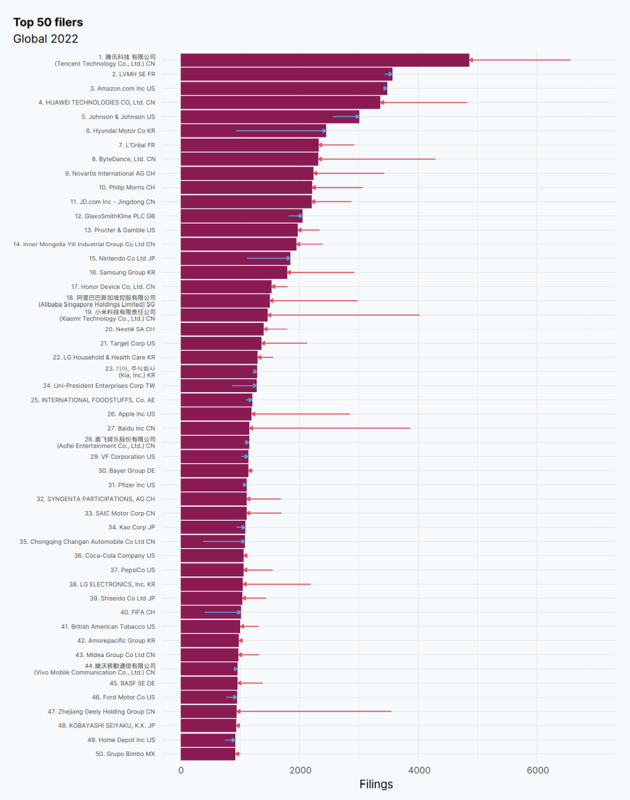

- Tencent tops list as most prolific global filer of trademarks, followed by LVMH, Amazon, Huawei and Johnson & Johnson

- US and European countries take a larger share of the top five rankings compared to 2021

- Chinese companies saw the sharpest decline in filing, including notable year-on-year drops from Tencent, Huawei, ByteDance, Xiaomi and Baidu

26 June 2023 – London – Trademark and brand protection technology business Corsearch has revealed that China and the US dominate the list of the top 50 companies for trademark filing in 2022, with data from the Corsearch Trademark Industry Report released in May of 2023 at the International Trade Association’s annual meeting in Singapore.

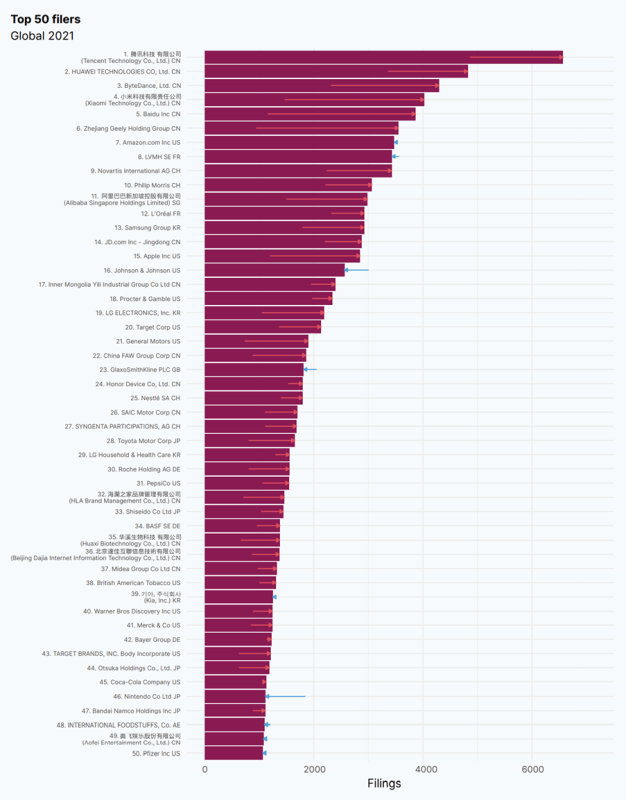

In comparison to 2021, the top five filers has seen some changes with far less dominance from Chinese companies in 2022. In 2022, ByteDance, Baidu and Xiaomi dropped out of the top five, with ByteDance moving from third to eighth place, Baidu falling sharply from fifth to 27th and Xiaomi dropping from fourth to 19th place.

These companies were replaced in the top five by Amazon, rising from seventh place in 2021 to third place in 2022; LVMH which rose from eigth to second place; and Johnson & Johnson, which moved up from 16th to fifth.

The report finds China features 14 entries into the Top 50, whilst the US features 12. However, Chinese companies dominate nearer the top.

South Korea ranks as the country with the third most active companies, featuring six entries in the Top 50 rankings, whilst Switzerland has five and Japan four. Looking at broader regions, APAC pulls ahead of North America and Europe, with 26 entries in the Top 50 compared to only 13 in North America and 10 in Europe.

However, the average number of filings has decreased year on year, – in 2021, the top 20 filers all filed more than 2,000 trademarks across the period, whereas this figure was only achieved by the top 12 in 2022.

The full report can be read on the Corsearch website here.

Stephen Stolfi, Chairman of Customer & Industry Advisory at Corsearch, commented:

“Our report shows that the level of filings year on year has fluctuated, with China retaining its expected prominence, but witnessing significant falls in filing from 2021’s most active businesses, allowing North America and Europe to edge up the rankings.

“Evident opportunities remain for IP lawyers and the companies they represent to capitalise on new verticals not only in these regions, but specifically in the more active sectors revealed in our report, including amongst agriculture, foodstuff, advertising and the business product classes.

“The global economic turmoil in 2023 will create further interesting changes next year, as the world reacts to the fallout from rising inflation and the supply chain shock of geopolitical tensions over the past two years, as well as emerging opportunities in digital, sustainability, health and wellness, crypto and cannabis. It will be interesting to see the picture that next year’s report paints on how these most active companies have reacted.”

Methodology:

The Trademark Industry Report is compiled from trademark applications data in 187 registries. As a generality, this will also include unpublished applications where relevant.

As always with trademark data, there is a wide variation in the completeness of the information provided. Some unpublished applications can be incomplete or missing altogether. Human errors in completing the applications, such as misspellings can contribute to data quality along with handling errors.

Consequently, the data and analysis provided in this Trademark Industry Report is for the purposes of information only and should not be relied upon for any other purpose. Corsearch, its employees and affiliates accept no liability for improper use of the information provided.

About Corsearch:

Corsearch intelligent Trademark & Brand Protection solutions are revolutionizing how companies commercialize and protect their most valuable assets. Trusted by over 5,000 customers worldwide, Corsearch delivers AI-powered data, deep analytics, and professional services that protect trust in brands.