Official statistics for 2024 are out, and it is confirmed that following the initial recovery of trademark and design applications in 2023, the positive trend has consolidated in 2024, with more than 303,000 European Union Trade Mark (EUTM) and Registered Community Design (RCD) applications filled at the EUIPO.

This represents a 4% increase over 2023, and this makes 2024 the European Union Intellectual Property Office‘s (EUIPO) second-best year in its history, just behind its record year 2021 with 313,891 applications.

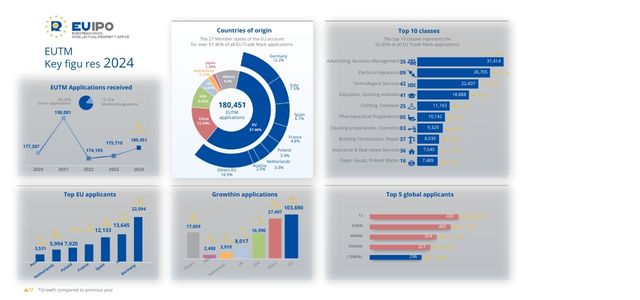

Looking at trademarks in 2024, the EUIPO received 180,451 EUTMs in 2024, marking a 2.7% increase over 2023. The majority of the applications, more than 57%, came from within the EU, with German companies accounting for 12% of EUTM applications, followed by Italy (7.6%), Spain (6.7%), France (4.8%) and Poland (3.9%). Globally, Chinese companies generated the greatest number of EUTM filings in 2024, accounting for more than 15% of all filings. Chinese filings grew the most in 2024, up almost 16% over 2023. Other large non-EU filing countries included the USA (9.4%), the UK (4.4%) and Switzerland (2.2%).

The top 10 NICE classes are present in about 53% of EUTM filings, with Class 35 (Advertising, Business Management, Class 9 (Electrical Apparatus), and Class 42 (Technological Services) the most frequently occurring classes. Among the top 10 classes, Class 5 (Pharmaceutical Preparations) showed the highest growth in 2024, up more than 5% over 2023.

In 2024, the EUIPO received 123,164 designs, up 6.2% compared to 2023. This represents the highest number of RCD filings in the history of the Office and underscores the growing importance of design in the European and global economies. About 45% of these applications came from EU Member States. As in the case of trademarks, Germany was the largest EU source of design filings, accounting for close to 15% of RCDs in 2024, followed by Italy (12%), France (4.4%), Poland (3.9%), the Netherlands (3.2%) and Spain (3%). But by far, the highest share of design filings came from China: almost 27%. Other non-EU countries with significant shares of RCD filings were the USA (8.4%), Switzerland (3.3%) and the UK (3.1%). China also showed the fastest growth in RCD filings, up almost 24% compared to 2023, but filings from Germany, Switzerland, and the Netherlands also grew at double-digit rates in 2024.

Mirroring the increase in incoming applications, the number of trademark and design filings examined by EUIPO increased in 2024 by 0.6% and 7.5%, respectively. The number of opposition decisions declined by 6.4% in 2024, while cancellation decisions rose by 7.9%. This is a reflection of efforts made to reduce the stock of pending opposition decisions, allowing the examiners to focus on clearing the pending cancellation proceedings. Also, the EUIPO is making an active effort to encourage parties to look for amicable settlements in such proceedings, including making use of EUIPO’s Mediation Centre. The number of appeal decisions rose by 1.1% in 2024, reflecting the overall increase in decisions taken in the first instance.

The healthy growth in filings at EUIPO in 2024 shows the resilience of the IP and innovation systems, as well as a reflection of favorable economic conditions. Undoubtedly, it was also influenced by the actions of EUIPO and the National and regional IP Offices of EU Member States, its partners in the EU Intellectual Property Network (EUIPN). In particular, many small and medium-sized enterprises (SMEs) applied for a trademark or design for the first time. Many of those filings were made thanks to support provided by the SME Fund, which received close to 32,000 requests in 2024 and more than 100,000 requests since 2021.

The EUIPO wishes to acknowledge the positive dynamic shown by innovative businesses in the EU and worldwide in 2024, as well as thank all its users for the trust they have placed, once again, in the EUIPO.

The EUIPO looks forward to continuing to cooperate closely with all its stakeholders and strategic partners in contributing to further support competitiveness and innovation-driven economic growth.

You may also like…

EUIPO and UANIPIO welcome the integration of Ukraine’s trademarks into TMview

The European Union Intellectual Property Office (EUIPO) and the Ukrainian National Office for Intellectual Property...

Jägermeister succeeds in opposing the EU trademark application Alten Kräuterfrau for alcoholic beverages

Mast-Jägermeister SE filed an opposition on the grounds of Article 8(1)(b) – likelihood of confusion between the signs...

INTA’s Brand & New podcast wins prestigious w3 Award for “Inside the Dupe Revolution” series

New York, New York—October 14, 2025—The International Trademark Association (INTA) is proud to announce that its...

Contact us to write for out Newsletter